Shocking numbers from the 5-year bull market

The raging U.S. stock bull market turned five-years-old on March 9. We all know stocks have come back, but by how much may surprise you.

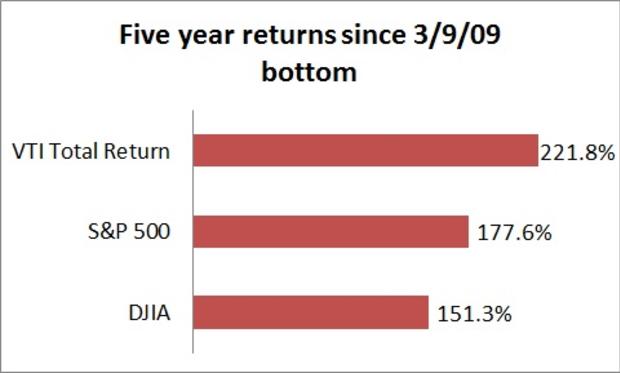

For example, those with the cash and the courage back on March 9, 2009, would have seen their investment more than triple. An investment of $10,000 in the Vanguard Total Stock Market ETF (VTI) would be up 221.8 percent and be worth $32,180 with only letting dividends reinvest.

By comparison, over that time the S&P 500 index has risen 177.6 percent, and the Dow Jones industrial average is up 151.3 percent. The indexes are only part of the market return, as they exclude dividends and leave out a majority of U.S. stocks.

It wasn't so easy to hold stocks back in March 2009. Mired as we were in a recession second only to the Great Depression, investors feared for the future of capitalism. Though stocks were on sale, few were buying.

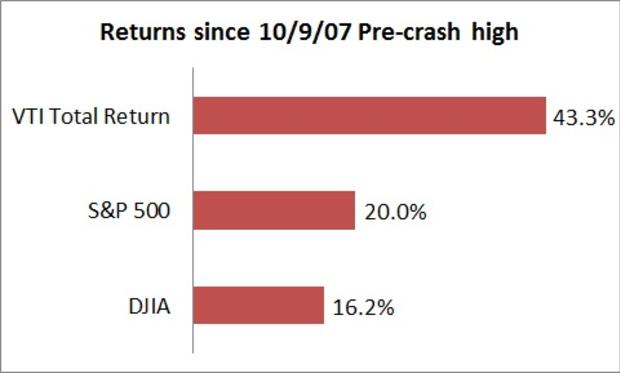

What may be most surprising, shocking to me, is how stocks have performed since the market's pre-crash high on Oct. 9, 2007. At the time, the conventional wisdom was that real estate could never decline in value and credit default swaps were sophisticated, AAA-rated investments. Lehman Brothers was a big force on Wall Street.

Clearly, we were in collective la-la land, as the housing bubble was about to pop big time. Although ensuing meltdown was devastating, a $10,000 investment made on Oct. 9, 2007, today would be up 43.3 percent , or worth $14,330. Again, that's the total return of the U.S. stock market, while the S&P 500 index is up 20.0 percent and the Dow is up only 16.2 percent. The total market return of 43.3 percent translates to a reasonably respectable 5.7 percent annualized return.

My view is that investing based on market commentary was destructive during the 2007 pre-crash market high and the 2009 market bottom, remains destructive today, and will continue to be so tomorrow. Our own emotions are perhaps our worst enemy when it comes to investing, as evidenced by investor funds flowing out of stocks through 2012, just as the market hit a new all-time high.

My research shows that a balanced portfolio of U.S. stocks, international stocks and bonds that rebalanced regularly had greater returns than each of the components over the past 15 years. That's because rebalancing meant buying after bubbles pop and selling during the supposedly new paradigms in which stocks supposedly rise forever. (Speaking of a simple rebalanced portfolio, my book "How a Second Grader Beat Wall Street" came out the day the market bottomed on March 9, 2009. How's that for timing?)

The lesson: Neither good times nor bad last forever.

How did this simple rebalanced portfolio mentioned above perform? The Second Grader Portfolio is one of the eight Lazy Portfolios tracked by Paul Farrell at MarketWatch. This three-index fund portfolio clocked a 21.71 percent annual return over the five-year bull run, earning the top-performing slot of the eight Lazy Portfolios. It bested portfolios designed by the likes of financial theorist William Bernstein and Yale Endowment manager David Swensen. All eight simple rebalanced portfolios earned at least 16.89 percent annually and demonstrated the value of simplicity and removing emotion.