Revising my critical review of the Lending Club

(MoneyWatch) On May 1, I wrotea critical review of the Lending Club, an online financial community that brings together credit-worthy borrowers and savvy investors for the benefit of both. In that review, I was critical that the company was systematically overstating investor returns. Now the Lending Club is rolling out some changes that address the issues I raised and I've taken another look at the service.

The Lending Club offers a very innovative way to connect lenders and borrowers. Much like the internet eliminated the need for travel agents, the Lending Club allows borrowers and lenders to bypass middlemen like banks or credit unions when obtaining a loan. Borrowers pay an origination fee to receive up to $35,000 in unsecured loans. Lenders pay a servicing fee to buy portions of loans as small a $25 each. They get a return on their investment as their portfolio of notes are paid off in full with interest. This service is known as peer-to-peer lending and you can read more about it at Lend Academy. Prosper is another example of a peer-to-peer lender.

In my May analysis, I reached the conclusion that the Lending Club was overstating returns by a material amount because it was still including the full value loans that were delinquent, but had not yet hit default status. Thus lenders' expectations of returns would be higher than they would likely achieve and those lenders might decide to invest more of their capital based on unrealistic expectations. Once the note hit default status, defined as 120 days late, the Lending Club would change the note value from the full outstanding principal to worthless.

Obviously, the value of these notes decline when they are late, and the more delinquent they are, the lower the probability of eventually collecting. The Lending Club took the position that it could not estimate how much to discount each note when it was late and thus included the full value until it was officially in default.

While not agreeing with all the points raised in my article, Lending Club COO Scott Sanborn said then that the company may make some future changes in how it reports returns to its lenders. The Lending Club allowed me to preview the changes and unveiled some of these changes this week.

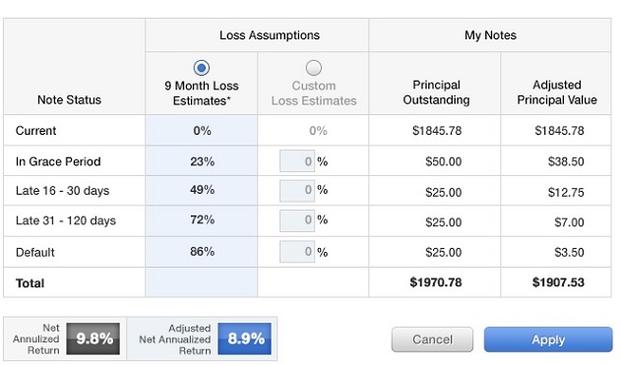

Now, the Lending Club will report returns as it has in the past, but it will also include an option where the lender can look at estimated returns using past experiences on late notes. Its default view using this option will mark down the principal values as shown, based on aggregate experiences of the total of all Lending Club notes.

Late 1-15 days - 23 percent discount

Late 16-30 days - 49 percent discount

Late 31-120 days - 72 percent discount

Default - 86 percent discount

So this view gives a much better estimate of what the actual return will be. In the screen shot example below, with the click of a button, the account holder is able to get a better estimate of her ultimate return as the delinquent notes are discounted. In this example, the 9.8 percent annualized return is adjusted down by 0.9 percent for a new estimated 8.9 percent annualized return. If investors want to use different default assumptions, they can customize those assumptions.

This is a similar method to that employed when a bank marks down its loan portfolio based on the payment status of each loan. It's not the "mark to market" accounting practice, since the Lending Club is making no representation these discounts reflect market rates -- just past experiences.

This accelerates the impact of likely charge-offs and gives the investor a more realistic expectation of return. Still, the Lending Club will be taking one additional step in helping investors assess their performance: Sanborn states that some of the current notes receiving no discount may eventually default. Also, the fee charged by the Lending Club to service the notes is composed of a larger percent of outstanding principal as the note is repaid over time. This causes lenders' annualized return to drop, even without additional defaults.

So the Lending Club will be coming out with additional guidance showing approximate ultimate returns based on platform history. In this example, it may show the ultimate expected return from this portfolio will decline, say, another one percent resulting in a 7.9 percent expected return.

My take

I've written critical reviews before and responses have ranged from respectful disagreement to threats of a lawsuit. This is a first for me in that the Lending Club both acknowledged the bias and corrected it. In my mind, the expected default rate should be the main screen, and the user should have to click on an option called "perfect portfolio with no additional defaults." But its enhancements do a great job of giving lenders on its platform a much better way of assessing the ultimate expected returns.

For investors looking to earn a bit more with their money, the Lending Club may be appropriate for some portion of their savings. One should remember, however, that these are illiquid and unsecured loans and are not substitutes for safer options like CDs or government bond funds. I have a tiny portion of my portfolio in the Lending Club and consider it part of my 'fun' portfolio.