Global clouds darken U.S. economic outlook

For months, most economists and pundits have confidently predicted that the U.S. would escape the storm being whipped up by the ailing global economy. President Obama, too, couldn't resist a little chest-thumping recently after federal data showed that the nation's unemployment rate had fallen in January to 4.9 percent.

Such optimism looks increasingly misplaced. A raft of economic signals shows that slowing growth overseas, held back by China's ongoing deceleration, is already taking a toll on the American economy and threatening to send the recovery into reverse. Private forecasters are paring their 2016 estimates for U.S. growth to around 2 percent, down from the already modest 2.4 percent rate of expansion over the previous two years. And that assumes everything goes right.

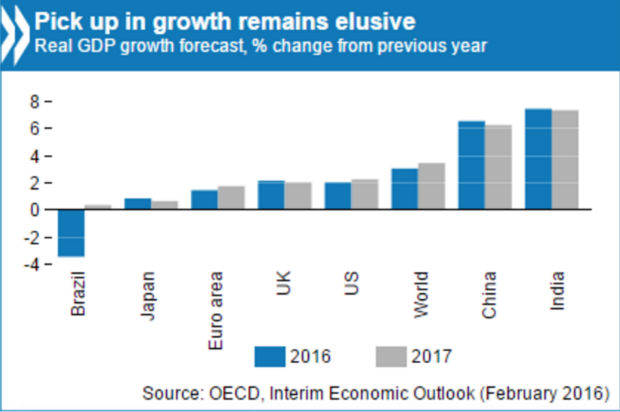

If things go wrong, even those tepid projections are likely to slip. The Organization for Economic Cooperation and Development has already downgraded its forecast this year, leading the group's chief economist to say that "global growth prospects have practically flat-lined." The downturn is evident not only in Asia, but also in Europe and Latin America, where Brazil and Venezuela are already in recession and Argentina is close on their heels.

Although there is never an opportune time for a recession, the current moment poses singular challenges for the U.S. The economy has failed to regain the momentum it had before the 2008 financial crisis, while questions abound regarding the country's long-term prospects. Some prominent economists argue that we may be in store for years of "secular stagnation," potentially widening the cracks in the economy caused by inequality and eroding Americans' standard of living.

That unsettling sense of stasis, especially with tens of millions of Americans already just getting by, coincides with what is emerging as the most serious threat to global expansion in decades. This much is clear: The challenges facing China and other developing countries are, in an economically interconnected age, also our own. If the storm does come, national borders are unlikely to offer shelter.

Green flags

One major sign the American economy is losing steam: U.S. corporate profits are taking a beating. Through Feb. 19, with nearly 9 out of 10 S&P 500 companies having reported or estimated their fourth-quarter 2015 results, earnings for the period are down 3.6 percent, according to FactSet. That represents the biggest profit slide since late 2009, when the economy was reeling from the Great Recession.

If that trend holds for the final batch of companies reporting earnings, profits will have declined for five straight quarters. The new year appears to be bringing no relief. Of nearly 100 companies that have offered a snapshot of their January and February results, 80 percent have warned of weaker earnings.

Highlighting the blowback from overseas, companies with more global exposure are doing far worse than businesses focused on the U.S. Fourth-quarter earnings growth for S&P 500 companies that get more than half their revenue from domestic sales was 2.7 percent, FactSet reports. For enterprises that get most of their sales from abroad, earnings for the period fell 11.2 percent, as the worsening global economy curbs demand for their products in China and other key markets.

For now, it is makers of construction, mining and other industrial equipment that, along with energy producers, have taken the biggest hit from the trouble in emerging markets and plunge in oil prices. Bellwethers such as Caterpillar (CAT), Deere & Co. (DE) and Exxon (XOM) all recently cited headwinds in China in reporting tough quarters.

"Global economic growth continued to slow during the fourth quarter across nearly all major economies. In the U.S., estimates show growth softening further since the third quarter," one Exxon executive said earlier this month in reporting a nearly 60 percent drop in profits.

Robert King, a senior economist with the Jerome Levy Forecasting Center, said he expects company earnings to continue sinking this year, noting that the decline is already hurting business confidence and investment.

"The big machine producers -- the big steel producers, the mining and oilfield machinery producers -- we're hearing them talk about cutbacks in their own investment and in their workforce," he added. "That has knock-on effects. Once you start cutting employees and cutting their income, that hurts consumer spending, housing and the rest of the economy."

However, it isn't only capital goods producers that are feeling the effects of the downturn overseas. A "profits recession" is also starting to make itself felt in the U.S. across a range of industries. Even excluding beaten-down energy players, S&P 500 companies that depend on exports for most of their sales saw their profits growth fall 3.2 percent between October and December.

Large U.S. banks, whose shares have fallen sharply this year amid concerns about their exposure to the energy and commodities sectors, are also seeing an impact, as are some of the country's biggest retailers.

"We have faced specific challenges in our largest e-commerce markets outside the U.S.," Walmart (WMT) CEO C. Douglas McMillon told analysts last week, highlighting the weakening conditions in emerging markets after the retail giant reported disappointing financial results. "Economic softness in Brazil and China continued to weigh on growth," he added.

Another sign the global slowdown is hurting the U.S.: The Federal Reserve says so. That isn't the scenario monetary policymakers expected in December when they raised interest rates for the first time in a decade. While acknowledging the impact of weakening global conditions on commodity and energy markets, "the underlying health of the U.S. economy I consider to be quite sound," Fed Chair Janet Yellen said at the time.

But she and other Fed officials sounded decidedly less certain after taking the economy's vitals only a few weeks later. In an account of the Federal Open Market Committee's Jan. 26-27 meeting, policymakers cited the risk that tighter financial conditions, the stronger dollar and higher corporate borrowing costs could slow economic growth this year. Indeed, members of the panel, which sets short-term interest rates, practically threw their arms up in the air, repeatedly citing the "uncertainty" around the U.S. and global economic outlook.

"The Fed is starting to recognize the gravitational pull from the rest of the world on the U.S. economy," said Joe Quinlan, chief market strategist at U.S. Trust, which has $376 billion under management.

No ordinary rabbit

Why aren't more experts sounding the alarm about the threat facing the U.S. economy? Habit, in part. Economists commonly downplay the risks of recession (sometimes spectacularly so, as did former Fed chief Ben Bernanke in July 2007 when he predicted the U.S. was likely to strengthen the following year).

This time around, the origin of the threat may also be a factor. The U.S. has never had a recession that started abroad. In scanning the data for signs of distress, economists typically pay particular attention to America's job market and to consumer spending, which accounts for some 70 percent of economic activity.

By those measures, the risk of recession currently seems fairly low. The U.S. jobless rate is at its lowest level since February 2008, while average hourly wage growth is up to a post-recession high of 2.5 percent. Consumers are spending at a healthy clip, while the housing sector continues to dust itself off from the subprime crash. Data last week that showed inflation edging up also could, if the trend is sustained, suggest that the economy is gaining speed.

But these positive signals may simply indicate that the downturn overseas has yet to reach our shores. The full impact of that slowdown has yet to be felt in the U.S., according to the Levy Forecasting Center.

"We haven't yet seen [U.S.] employment convincingly weaken, we haven't seen retail sales fall dramatically and housing is holding up. But that's how these cycles play out," King said. "Once you're talking about an investment recession, you're talking about companies retrenching, and we're beginning to see that."

Meanwhile, solid hiring is no guarantee that the economy is on the right track. In late 2007, it's worth recalling, the U.S. economy was growing at an annualized rate of more than 4 percent -- by December of that year the country was in a full-blown recession. In other words, the labor market could remain robust even as growth is hitting a wall.

The changing shape of the global economy also may be obscuring the nature of the threat. In 1998, the U.S. economy was roughly 1.5 times the size of all emerging market economies combined. Two decades on, the proportions are exactly reversed. The U.S. also accounts for a significantly smaller share of world imports, meaning American consumers by themselves can't generate the demand needed to bolster ailing economies abroad.

The upshot? The U.S. no longer has the horsepower to pull the world economy out of the muck. But the world can pull us down.

Tunnel vision

In some ways, we're experiencing what Bank of America analysts call a "bad Goldilocks" moment: The U.S. is too weak to yank the global economy out of its rut, but not weak enough to spur a coordinated global response to stimulate growth. Political and corporate leaders mostly point to the same foe -- insufficient economic demand, particularly in China and other emerging markets with factories sitting idle -- but so far that has failed to spring policymakers into action.

On the contrary, in tightening interest rates, U.S. central bankers are diverging from their counterparts in Europe and Japan, which have turned to negative rates in hopes of spurring lending and investment (Under this policy, central banks effectively charge lenders to hold their money in hopes of nudging them to issue loans and invest.) That divergence is heightening the strain on the global economy, roiling currencies and causing market volatility.

America and China, the world's two largest economies, have different, though related, problems. In the U.S., years of low interest rates have denuded monetary policy of its ability to energize growth. Even if the Fed hadn't moved to start raising borrowing costs in December, reversing course to trim them again could amount to "pushing on a string." That's how economist John Maynard Keynes is said to have described rate-cutting when people have little appetite for borrowing.

As for the kind of government spending that the U.S. has reliably used in the past to jump-start growth, partisan discord in Washington, along with the usual election-year high jinks, for now makes that a long-shot.

By contrast, the People's Republic has more room to ease borrowing conditions and free up credit for consumers and businesses. But China's vast investments in recent decades to expand its industrial base has left it with massive overcapacity, undermining the effectiveness of additional spending.

"China has always been able to pull more from future growth, but not anymore," King said.

That points to another possible blind spot for policymakers around the globe. After decades of torrid Chinese and emerging markets growth, the prospects of a prolonged slump may be difficult to perceive, let alone counteract. The widespread belief among economists that China will avoid a "hard landing" seems in part an article of faith, a bet that it can stay on course even as the country attempts a swift metamorphosis from an economy based on investment and manufacturing to one based on consumption.

It is a dangerous bet -- one that many Chinese themselves seem unwilling to make judging from the billions of dollars they have withdrawn from their economy in search of safer financial havens around the world.

The U.S. economic picture isn't entirely bleak, of course, nor is another recession a foregone conclusion. The domestic job market has proved resilient, while wages -- a key yardstick of economic health -- are ticking up. In the corporate sphere, the damage from the slump in oil and other commodities remains mostly confined to the energy and materials sectors, at least for now. Many economists and other experts continue to expect the economy to rebound in the second half of the year.

But as storm clouds gather over the U.S., it pays to remember that the experts have been wrong before.